betterment tax loss harvesting cost

What is tax loss harvesting betterment. Identify Tax Loss Harvesting Ideas To Help Your Clients Keep More Of What They Earn.

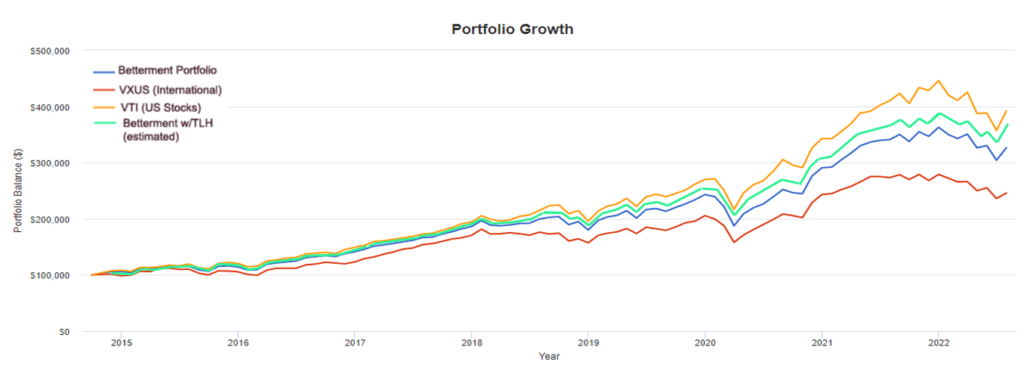

We Just Saved 42 000 By Not Switching To Betterment Early Retirement Now

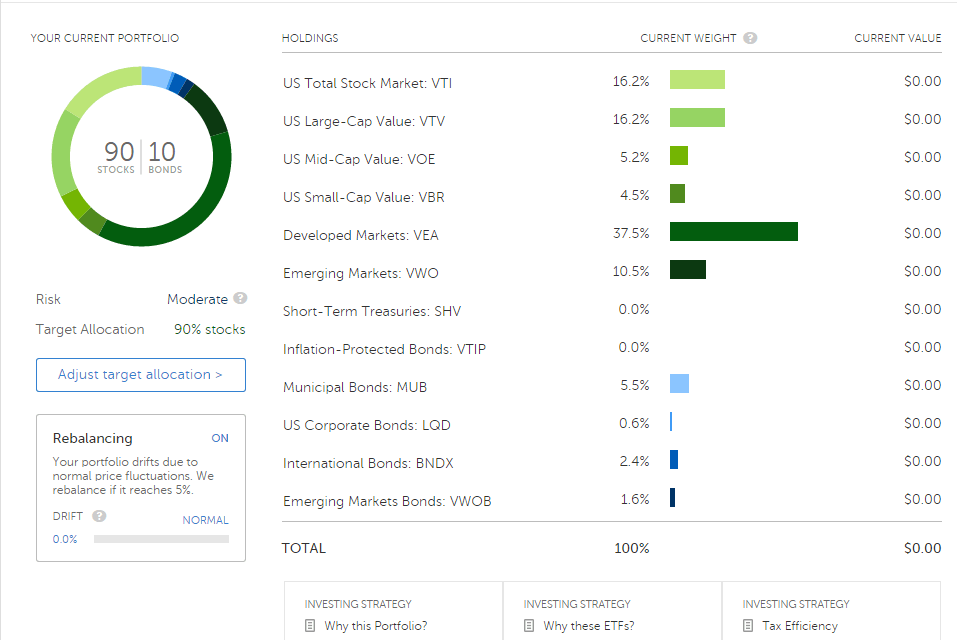

My 401k is at Fidelity and my wifes 401k is at Schwab.

. A bit of a random question. Ad Upload Your Portfolio In Tax Evaluator And See Funds To Tax-Loss Harvest. Down Markets Offer Big Opportunities.

Low Fees Transparency. Find A Registered Investment Advisor. This year we would like to start investing into taxable.

Ad Get Help Achieving Financial Goals From An Advisor Held To A Fiduciary Standard. The sold security is replaced by a similar one maintaining an optimal asset allocation and. Learn How to Harvest Losses to Help Reduce Taxes.

The amount of gain or loss is equal to the net proceeds of the sale minus the cost basis. The company has roughly 12000 offices worldwide. Ad Get Better Wealth Management With Tax Efficient Investing options Trust Accounts.

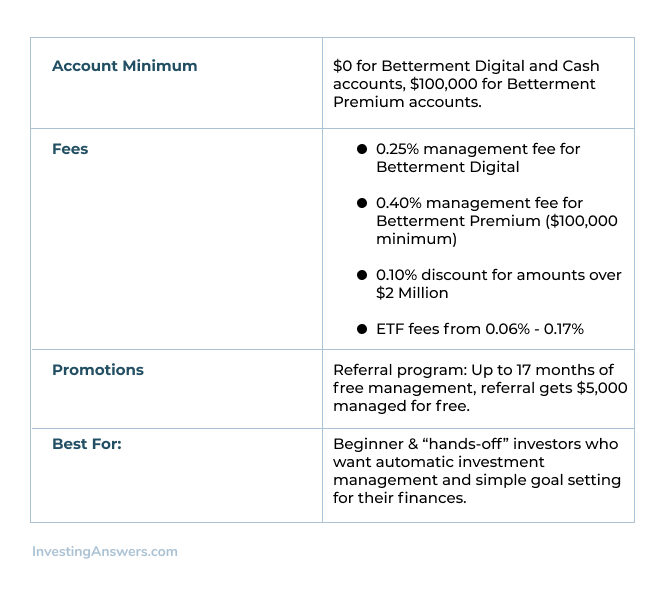

Im looking at a tax bill of roughly 6k. Betterment Tax Loss Harvesting Cost. A Smarter Way To Invest.

Ad Put Our Robo-Advisor To Work Keep Your Investments On Track With A Tailored Portfolio. Learn More About American Funds Objective-Based Approach to Investing. This can create short-term capital gains tax that may dramatically reduce the.

They Are Required To Act In Your Best Interest. Using an investment loss to lower your capital-gains tax Because you lost 5000 more than you gained 25000 20000 you can. By lowering tax exposure this strategy can help you increase gains.

Betterment Tax Loss Harvesting Reddit. A Smarter Way To Invest. This exceeds the cost of betterments25.

General repair or maintenance to sustain an assets current value is not considered betterment and those. How much money does tax loss harvesting save. My wife and I use Betterment a roboadvisor to manage our IRAs.

Low Fees Transparency. Betterment is one of the few robo-advisors that dont require a minimum balance to provide clients with automatic tax-loss. Enabled by computer algorithms tax-loss harvesting can reduce ordinary taxable income by 3000 per year.

Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. Ad Get Better Wealth Management With Tax Efficient Investing options Trust Accounts. Some tax loss harvesting methods switch back to the primary ETF after the 30-day wash period has passed.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. I want to convert my traditional IRA to a Roth IRA and will have to pay taxes on the gains all the contributions were post-tax. Create A Digital Financial Plan That Provides A Customized Roadmap For Reaching Your Goals.

Betterment Review 2020 The Key To Easy Investing The Finance Twins

Betterment Investing Review Make Investing Automatic

Better Investing With Betterment

The Betterment Experiment Results Mr Money Mustache

Betterment Review Smartasset Com

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Tax Loss Harvesting Rules How To Tax Loss Harvest White Coat Investor

Betterment Review 2022 Pros Cons Features

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Betterment Review Smartasset Com

How Much Could You Be Losing To Fees

Betterment Review Customized Asset Allocation Human Financial Advisors My Money Blog

Betterment Review 2022 What You Need To Know About This Robo Advisor

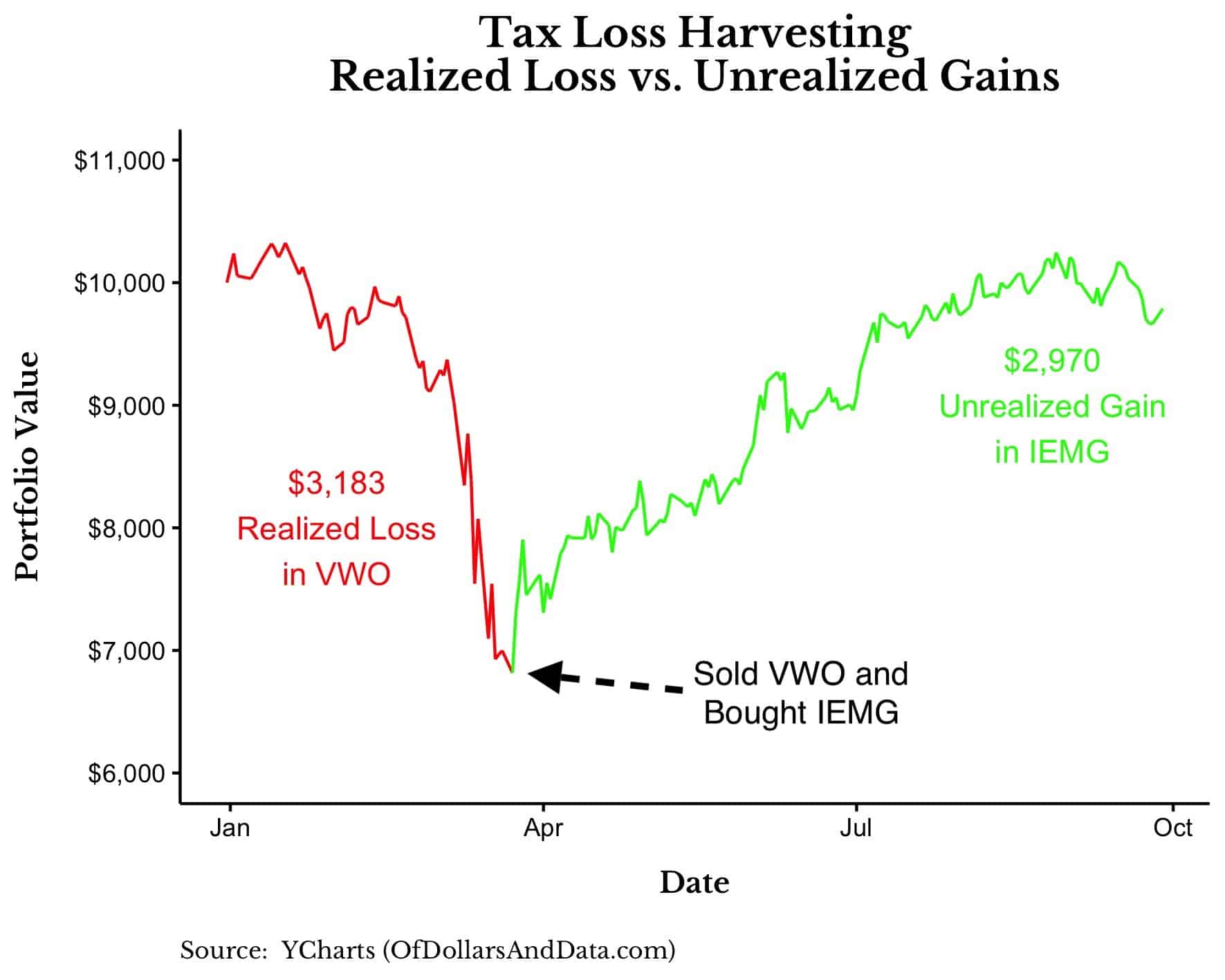

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

Tax Loss Harvesting How It Can Help Lower Your Tax Bill

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

A Detailed Review Of Betterment Returns Features And How It Works

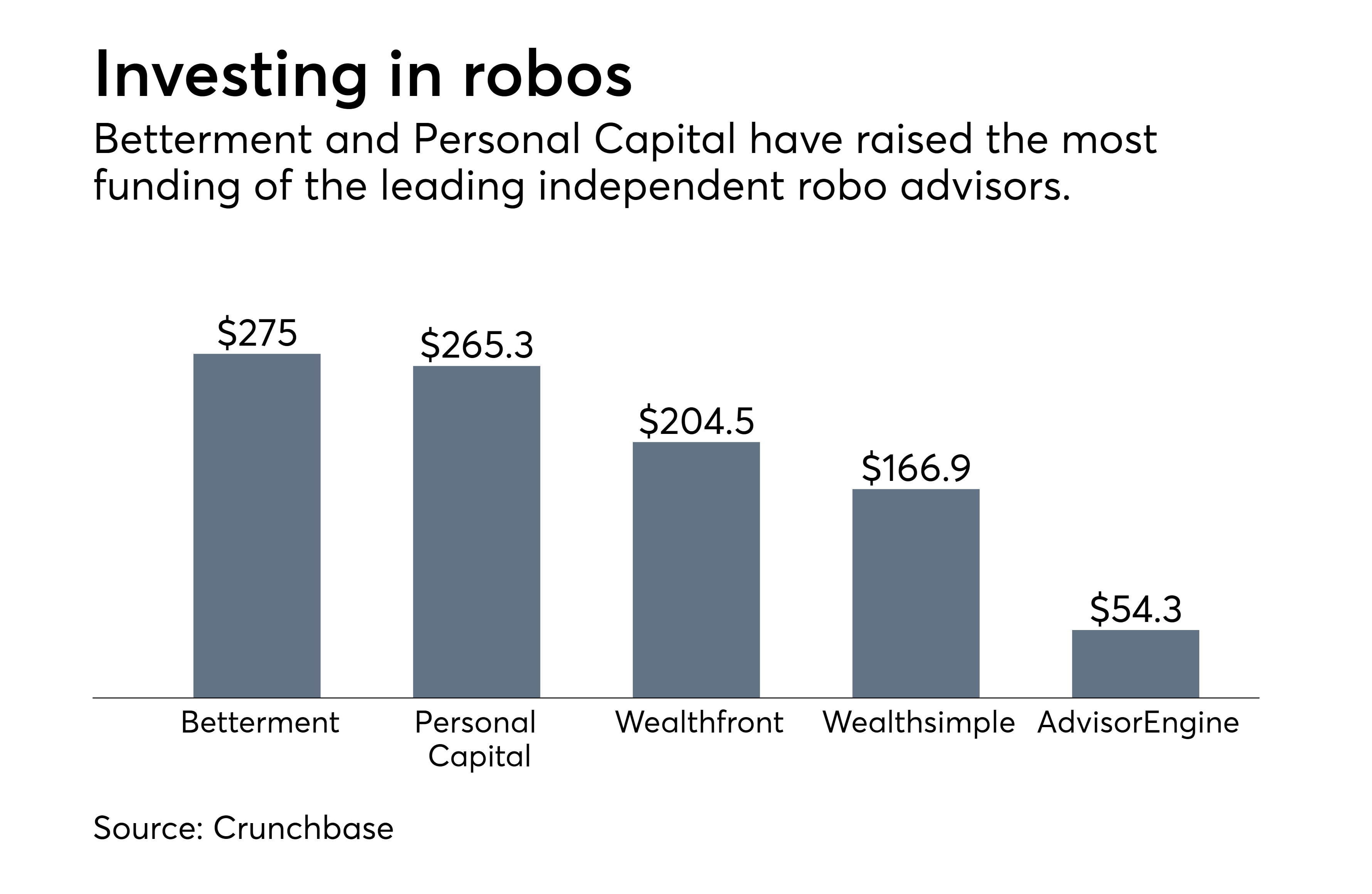

Betterment Drops Account Minimums On Custom Portfolios Financial Planning