san fran sales tax rate

Its the cheapest optionSample Travel DateFebruary 6th - 13th 2023This i. San Francisco Californias minimal combined sales tax rate for 2020 is 85 percent.

850 Taxing Jurisdiction Rate California state sales tax 600 San Francisco County sales tax 025 Special tax 225 Combined Sales Tax.

. A base sales and use tax rate of 725 percent is applied statewide. There is no applicable city. San Fernando CA Sales Tax Rate.

The South San Francisco California sales tax is 750 the same as the California state sales tax. Name A - Z Sponsored Links. Also what is the restaurant tax in San Francisco.

The December 2020 total local sales tax rate was 9750. 3 rows San Francisco County CA Sales Tax Rate The current total local sales tax rate in San. Next to city indicates incorporated.

This is the total of state county and city sales tax rates. This is the total of state county and city. 4 rows The 8625 sales tax rate in San Francisco consists of 6 California state sales tax.

San Geronimo CA Sales Tax Rate. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of. 4 rows San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco.

San Francisco 8625. Sales Tax Rate in San Francisco CA. This is the total of state county and city sales tax rates.

What is San Francisco sales tax. The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax. The current total local sales tax rate in South San Francisco CA is 9875.

Avalara provides supported pre-built integration. A good sale to VietnamVietnam introduced a new e-Visa system - take advantage of it. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

While many other states allow counties and other localities to collect a local option sales. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 2 P a g e Note. State Government Sales Use Tax.

The average cumulative sales tax rate in San Francisco California is 864. This is the total of state county and city sales tax rates. San Francisco CA Sales Tax Rate.

In addition to the statewide sales and use tax rate some cities and counties have voter- or local government. The minimum combined sales tax rate for San Francisco California is 85. The minimum combined sales tax rate for San Francisco California is 85.

San Gabriel CA Sales Tax Rate. How much is sales tax in San Francisco. This is the sum of the sales tax rates.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Avalon 10000 Los Angeles Avenal 7250 Kings Avery. How much is sales tax in San Francisco. The minimum combined sales tax rate for San Francisco California is 85.

California Sales Tax Rate By County R Bayarea

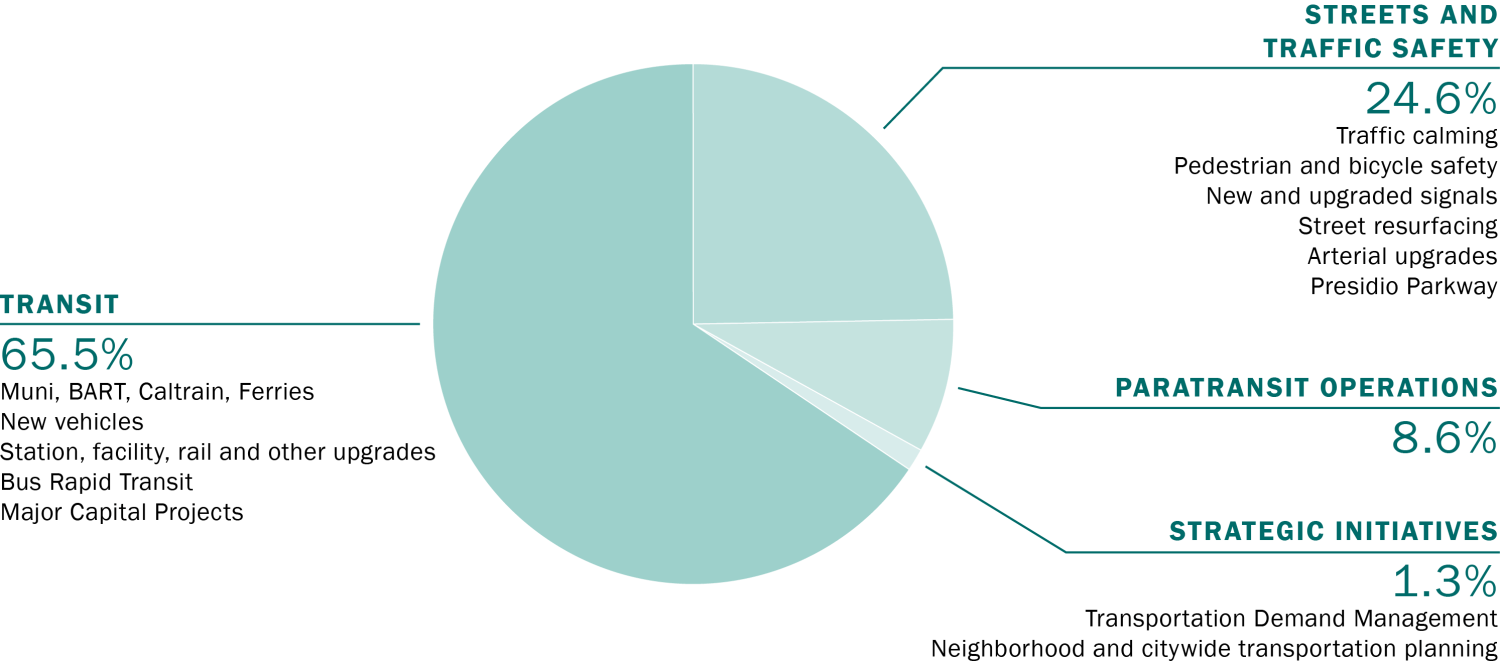

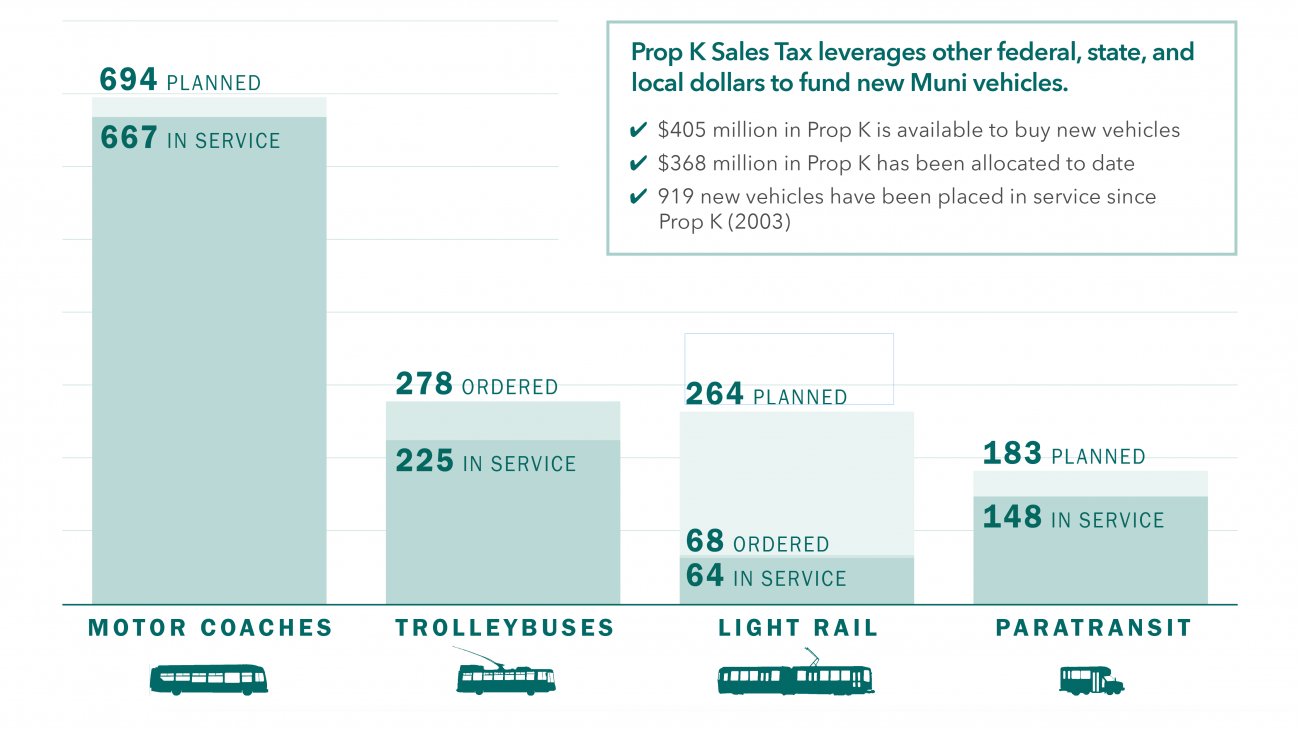

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

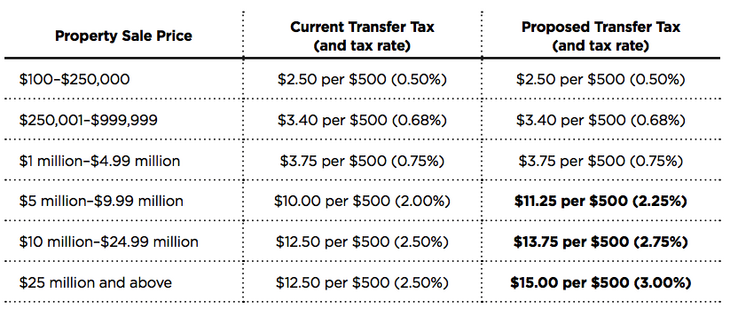

San Francisco Prop W Transfer Tax Spur

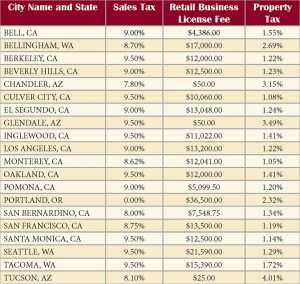

California Cities Among Most Expensive In West To Do Business Advocacy California Chamber Of Commerce

Understanding California S Sales Tax

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

California Sales Tax Rates By City County 2022

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

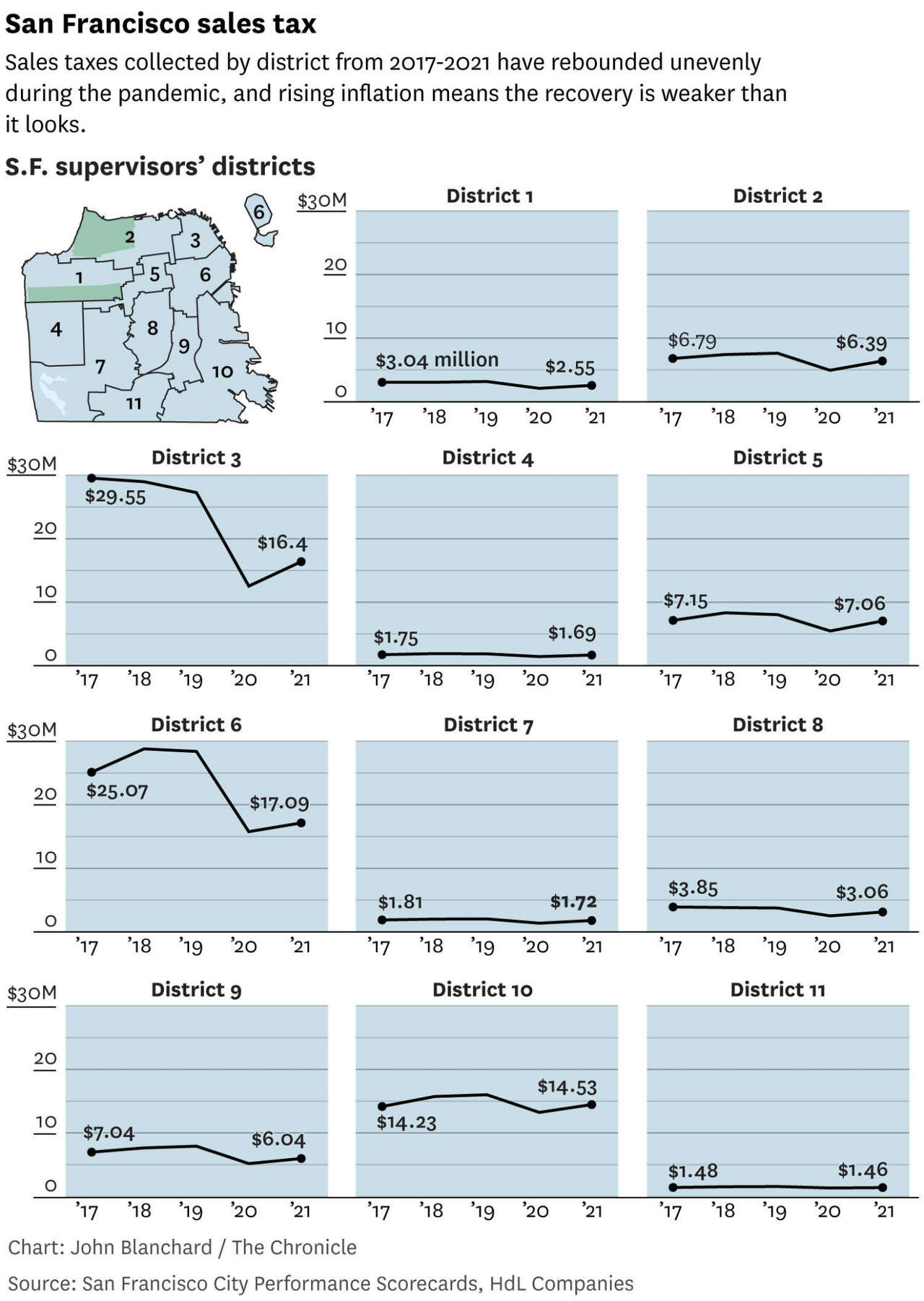

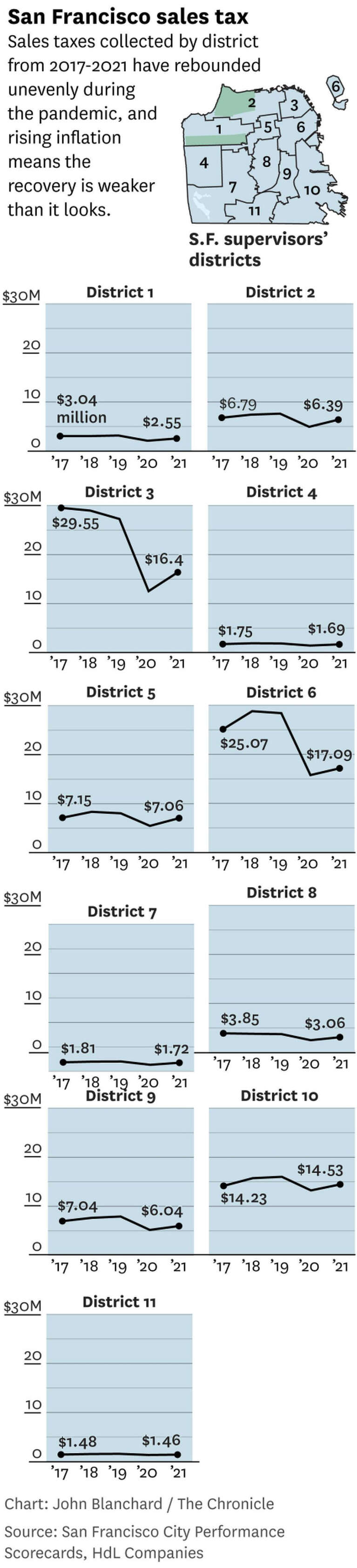

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Sales Tax Collections City Performance Scorecards

Understanding California S Sales Tax

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco Prop W Transfer Tax Spur

What Is The True Cost Of Living In San Francisco Smartasset

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money